- Gold price trades around key $1,830 support, awaiting next catalyst.

- Market will scrutinize last Federal Reserve meeting minutes looking for more monetary policy clues.

- PCE disinflation should continue, but any surprise could have a notable impact on Gold.

Gold price keeps trading around the key $1,830-$1,835 support area on Wednesday as chippy market action continues while market players wait for the next price action catalyst. American stock markets closed Tuesday in the red, ignoring upbeat US S&P Global PMIs as surging geopolitical tensions over the first anniversary of the Russian-Ukrainian war dominated the sentiment. Rising US Treasury bond yields supported the US Dollar and dented Gold price.

Wednesday’s economic docket in the United States will be focused on the release of the Federal Open Market Committee (FOMC) Minutes at 19:00 GMT, where traders will look for clues on whether the Fed voting members are considering a return to the tightening monetary policy. This release could have a limited impact on the markets, though, as the Fed meeting took place before the ground-changing January Nonfarm Payrolls report, and it might be considered somewhat outdated.

Gold news: Small details in the FOMC Minutes can be market-moving

The Federal Reserve (Fed) will publish the minutes of its last policy meeting late in the American Session, with the whole FOMC assessing the monetary policy. It will be key to see whether some policymakers saw the need for the Fed to reconsider 50 bps rate hikes in case they saw enough evidence to suggest that the slowdown in inflation was temporary. Such a development could revive bets for a 50 bps hike at the next meeting and weigh heavily on Gold price.

Eren Sengezer, Senior Analyst at FXStreet, mentions that some FOMC members might have considered a return to higher interest rate hikes:

Cleveland Fed President Loretta Mester said last week that she saw a ‘compelling case’ for a 50 bps rate hike at the last policy meeting. On the same note, ‘I was an advocate for a 50 bps hike and I argued that we should get to the level of rates the committee viewed as sufficiently restrictive as soon as we could,’ St. Louis Federal Reserve’s James Bullard said.

If not, markets are unlikely to read too much into the FOMC Minutes ahead of the Fed March meeting, where the revised Summary of Projections will be unveiled.

US PCE disinflation trend to continue

The US Bureau of Economic Analysis (BEA) will publish on Friday at 13:30 GMT the Personal Consumption Expenditures (PCE) Price Index, the Fed’s preferred gauge of inflation. Gold traders and investors will watch the data release closely, as Core PCE inflation is forecast to rise by 0.4% on a monthly basis. Still, the annual figure is expected to decline to 4.1% in January from 4.4% in December. The market reaction should be straightforward, with a softer-than-expected monthly PCE inflation weighing on the US Dollar and vice versa, with Gold price reacting the opposite way.

Considering that the CPI report already revealed that inflation remained sticky in January, it would be surprising to see this data have a long-lasting impact on markets.

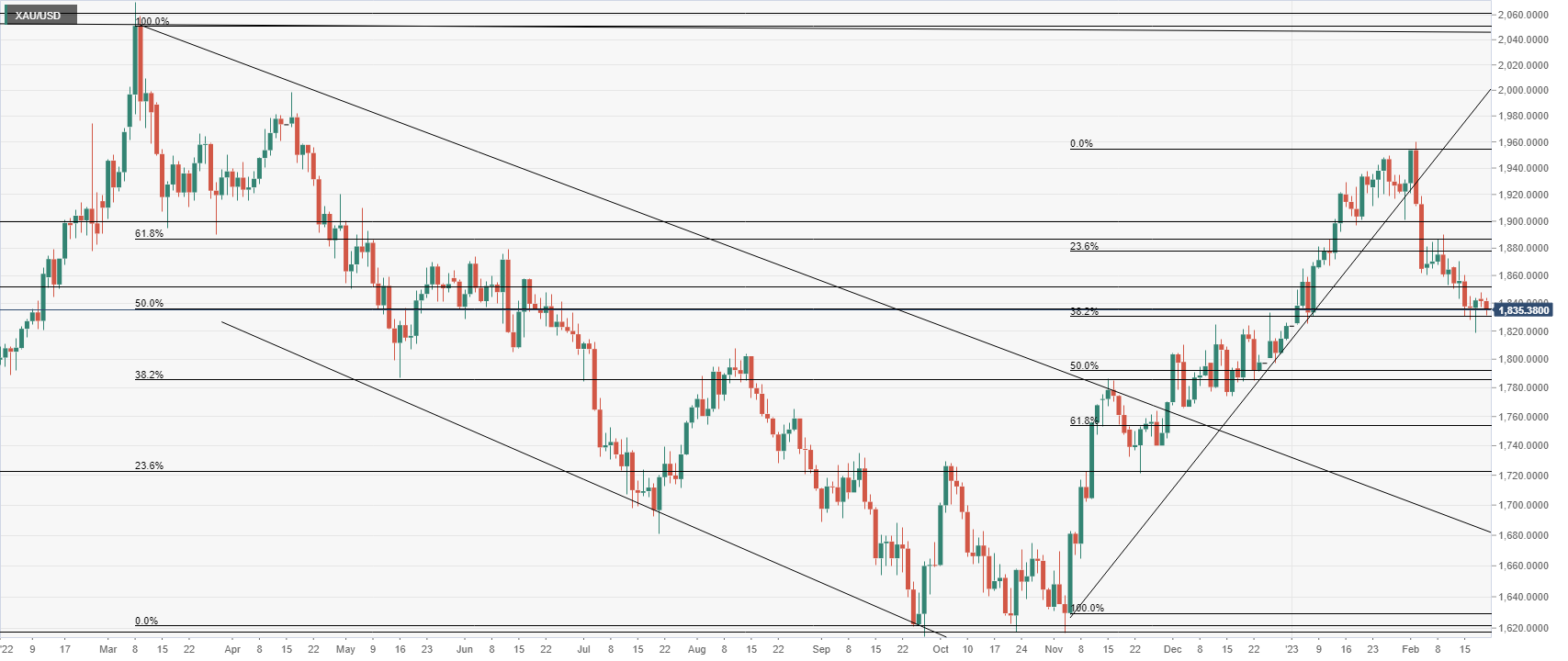

Gold price bears need to break below $1,819

Dhwani Mehta, Senior Analyst at FXStreet, takes a look at the Gold price short-term technical picture and points at key levels:

The critical horizontal trendline support from the January 5 low at $1,825 could hold the fort, as Gold sellers are seen threatening the $1,830 round figure. The next target for Gold bears is envisioned at Friday’s low of $1,819 on a sustained selling momentum.

Gold price in 2023: Up-and-down action

Financial markets have been a two-tale story for the early part of 2023, in which Gold price has reflected in its price action like no other asset. XAU/USD rode an uptrend during all of January with the market optimism about inflation slowing down and constant Federal Reserve dovish talk, only to see a drastic turnaround back to the old dynamics in February after a hot US Nonfarm Payrolls (NFP) report. The US economy adding more than 500K jobs in the month of January shifted the market expectations for the Fed easing its monetary policy, and the US Dollar has come back to the market King throne.

Gold price opened the year at $1,823.76 and reached a year-to-date high of $1,960 on February 2, right in between the first Federal Reserve meeting of the year and the surprising release of the US jobs report for January. Since then, the ongoing downtrend has been relentless, reaching levels close to the yearly open, around $1,830.